Stocks

At Morningstar, our approach to stock investing focuses on long-term advantages and intrinsic value. Learn about stock investing and see our analysts’ takes on latest stories.

Latest market reports Ratings & picks Investing in stocks Screen stocks Market insights & commentary

Latest market reports

Get the latest stock market news and research updates from our analysts.

View latest ASX report View latest global market report View upcoming dividends

Want to unlock more of Morningstar's research, insights and commentary? Sign up for a FREE 4-week trial^ of Morningstar Investor. No credit card required.

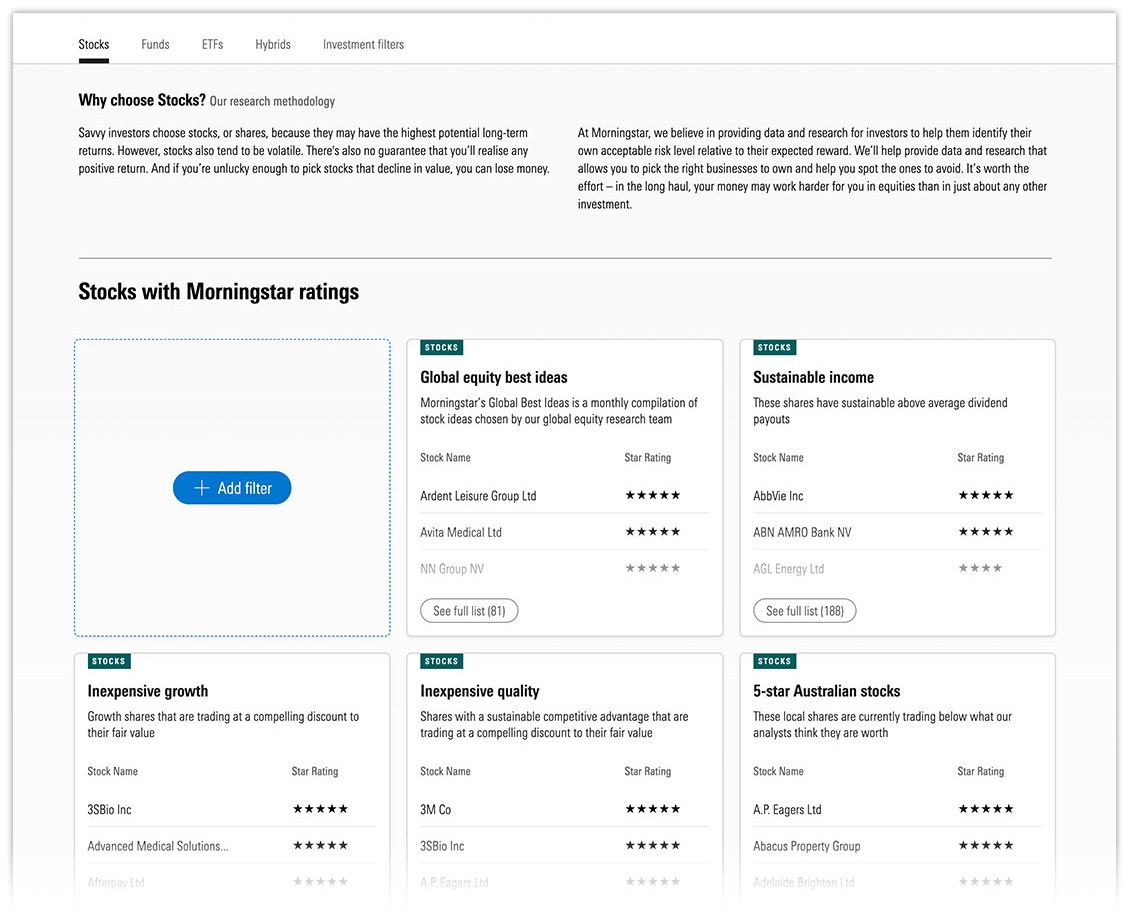

Ratings & picks

The Morningstar Rating for stocks can help investors uncover stocks that are truly undervalued, cutting through the market noise.

The rating is determined by three factors: a stock's current price, Morningstar's estimate of the stock's fair value, and the uncertainty rating of the fair value. The bigger the discount, the higher the star rating. 4- and 5-star ratings mean the stock is undervalued, while a 3-star rating means it's fairly valued, and 1- and 2-star stocks are overvalued. When looking for investments, a 5-star stock is generally a better opportunity than a 1-star stock.

To see our current top picks and 5-star rated stocks, sign up for a FREE 4-week trial^ of Morningstar Investor. No credit card required.

5-star Australian stocks

5-star North American stocks

5-star Asian stocks

5-star European stocks

Inexpensive growth

Inexpensive quality

Sustainable income

Australian stocks with moats

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

As the name suggests, purchasing a stock of a company makes you a partial owner of the business. That means that you own a portion of everything that the company has or does. This may take the form of tangible assets such as factories, equipment, real estate, cash and securities. Or intangible assets such as patents, trademarks, copyrights and brand names. As well as assets, buying a stock also means that you “own” a portion of any liabilities a company may have. This may take the form of debt and other obligations a company has, including payments to suppliers, wages and taxes.

At Morningstar, we take an owner-oriented approach to stock investing. What does that mean? When investors buy stocks, we don't think they're just buying tickers or stories. Rather, they're buying partial ownership in companies. As such, we think it's important to understand a company's fundamentals before purchasing its stocks.

Owning a stock of a company that is traded on the stock market is no different to setting up your own business. Small business owners don’t cavalierly sell their otherwise successful business because of one poor month of sales. They certainly wouldn’t sell their business if it grew significantly but slightly below the expectations. An owner’s mentality means taking a long-term view. Unfortunately, however, many things can conspire against even the most well informed investor.

Our approach to stock investing boils down to three basics: having an intimate knowledge of the company's sustainable competitive advantages, determining what its stocks are worth, and then only buying the stock when there's a significant margin of safety in doing so. Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock qualitative research on more than 1600 companies plus data on over 46,000 global securities, including analyst ratings, fair value price and more. No credit card required.

If you want to be a successful long-term investor it doesn’t get much easier than simply buying stocks in great businesses and holding them for a long time. So, what is a great business? At Morningstar we believe a great business is one that has a long-term competitive advantage, which allows it to fend off competitors while investing capital at a high rate of return. The long-term competitive advantage of a business is called an economic moat. Just as moats were dug around medieval castles to keep enemies at bay, economic moats protect the high returns on capital enjoyed by the world’s best companies. A company with an economic moat is quite rare because any time a profitable product or service is developed other firms respond by trying to produce a similar version, or even improving on the original version. Some companies are able to withstand the relentless competition of the marketplace and these are the wealth-compounding machines that an investor wants to find and own.

We believe there are five major sources of competitive advantage, or economic moat:

- Intangible assets: These can include brands, patents, or government licenses that explicitly keep competitors at bay. This can be seen in pharmaceutical companies with patent protection or with consumer brands that have long-standing and well-regarded brands.

- Cost advantage: Firms that can provide goods and services at lower costs have significant advantages over rivals as they can either undercut their rivals on price or sell at the same price and earn a higher profit margin. Generally, moats based on cost advantage are due to economies of scale. Economies of scale is defined as the cost advantages that companies obtain due to the scale of their operations with the cost to produce a product or service going down as output increases.

- Switching costs: Switching costs refer the inconveniences or expenses associated with a customer switching from one product to another. Banks can be good examples as it is time-consuming to switch bank accounts once you have set up direct deposits and payments.

- Network effect: The network effect occurs when the value of a particular good or service increases as more people use the good or service. Social media sites are perhaps the best example as a low number of members provides less of a benefit to a user than a high number of members.

- Efficient scale: Efficient scale applies to companies that serve limited markets where there are a small number of competitors. Potential competitors are discouraged from entering the market based on the small opportunity. An example can be a pharmaceutical company that produces drugs for diseases that only affect small patient populations.

Morningstar analysts assign a moat rating to select companies in our coverage universe. You can find the moat rating and a full description of the rationale for over 2,000 inside Morningstar Investor. Click here to get free access with a 4-week trial^.

There are countless ways to value a stock. At Morningstar we believe in fundamental equity analysis. A fundamental research approach means gaining a deep understanding of each investment. At its core, a fundamental investing approach means focusing on the future earnings of an investment and not its prospective price change. Our focus on fundamental research means we don’t fall victim to convincing stories to support the merits of an investment.

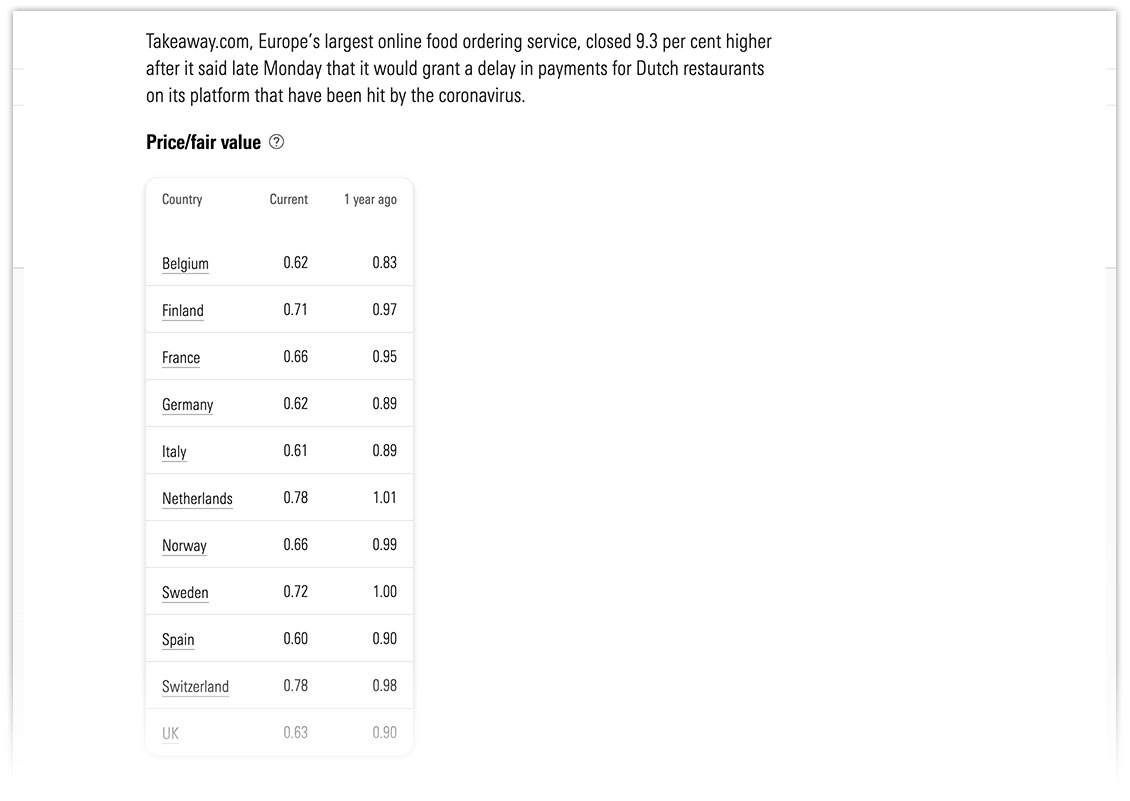

We believe that there is both an art and a science to valuing stocks. An art in deeply understanding the company, the product, the customers and the competitive landscape, and a science in being able to marry those understandings with the financial statements. The output from this analysis is a fair value estimate of the stock. We don’t care what the stock market says the stock is worth. We care what the underlying company is worth because we think in the long term that will be reflected in the stock price. Ultimately, Morningstar analysts believe a company's intrinsic worth is linked to the future cash flows it can generate.

Our fair value estimates are our take on what we think a company's stocks are worth. We look beyond fleeting metrics, such as a company's recent earnings or any stock price momentum. Rather, we calculate fair value estimates based on how much cash we think a company will generate in the future. Our fair value uncertainty rating--depicted as low, medium, high, very high, or extreme--depicts the level of uncertainty around our fair values estimate, based on things like a company's sales predictability, operating and financial leverage, and exposure to contingent events.

Lastly, the Morningstar Rating for stocks indicates whether a stock is undervalued (4 or 5 stars), fairly valued (3 stars), or overvalued (1 and 2 stars) based on where a stock's market price is relative to our fair value estimate, adjusted for uncertainty. To unlock more or Morningstar's ratings on over 1,600 companies, click here to get free access to Morningstar Investor with a 4-week trial^. No credit card required.

Screen stocks

Sift through our extensive data on more than 46,000 stocks to find investments which suit your goals and requirements.

Access premium stock screener* View basic stock screener

*Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to our premium stock screener. No credit card required.

View stocks by Morningstar Ratings

View stocks by classification

Share style

Sector

Market insights & commentary

Commentary and insights on the stock market from industry leaders and Morningstar’s global editorial team.

Access all articles in Morningstar Investor View free articles

Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to more articles. No credit card required.

^This offer is limited to new clients and cannot be used in combination with any other promotional offers and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

© 2024 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts