PORTFOLIO MANAGEMENT

Tips on Improving Portfolio Construction & Analysis

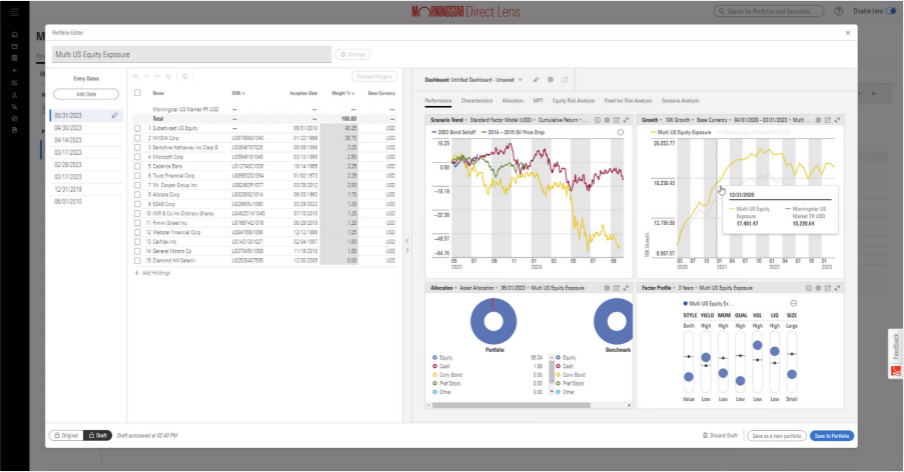

Morningstar Direct’s Lens capabilities take Direct’s portfolio construction workflow and analysis capabilities to the next level.

Regional bank failures. Cryptocurrency booms and busts. Sky-high interest rates. As one market cycle ebbs, a new shock looms on the horizon. How do you know if your portfolios are prepared for the next crisis? When funds form a significant heft of your portfolio, it complicates how you measure risk exposure and performance. Investment teams need to be able to quickly assess their portfolio, stress-test risk factors, and communicate findings across your firm.

Morningstar Direct’s investment analysis capabilities give financial professionals the ability to elevate their investment story to stay ahead of an ever-evolving market. By delivering proprietary datasets, forward-thinking research, and performance and risk analysis we are empowering you to showcase your vision.

1. Portfolio Centric Capabilities

With Direct Lens, you can easily import, edit and analyse portfolios all in one place.

Don’t wait until you’ve finished building a portfolio to dive into exposure factors. Build investment strategies and analyse them before they hit the market. As you go, you can evaluate how asset allocations and investment selections affect your portfolio. When you analyse portfolios in the same platform while you build them, instead of going back and reworking based on your findings, you can move faster. Tweak your investments and weights as you build to dial in your investment strategy.

2. Dynamic Portfolio Editing

Portfolio stress-testing models hypothetical market conditions so investment analysts can understand how their portfolio might act under pressure. It applies historical data to current markets so you can make forward-looking decisions about risk management.

With Direct Lens, you can make changes to your portfolio and immediately visualise the impact of those changes across the metrics that matter the most. You can also create custom scenarios and see how macroeconomic variables affect a portfolio. Test factors like changes to oil prices or the consumer price index.

3. Enhanced Data

Investment teams need to move data through different stages of the portfolio management lifecycle: portfolio construction, performance reporting, investment selection, and competitor analysis. Morningstar Direct helps lean teams move easily through the portfolio lifecycle process. Portfolio analytics is built on proprietary Morningstar data, research, and ratings. You can tap into our rich data universe to find the right investments to fuel your strategies. Then with clear fact sheets, you can share your recommendations with your team.

Access additional data capabilities within Direct Lens such as enhanced public equity data and the ability to view Global Access data (from Morningstar Sustainalytics). This aids in creating a more efficient workflow helping you see your investments more clearly than ever.

4. Holdings Look Through

With Morningstar Direct Lens, you can peel apart the layers of your portfolio to see the full impact of holdings and positions. Simply drill down to see the full impact of holdings and positions. Group by several key criteria to bring even more transparency to how a portfolio has been constructed.