Morningstar Advice Ecosystem

Transform your clients' financial future– and yours.

Efficiently match tailored investment propositions with client goals, objectives, values and risk tolerance to deliver personalised recommendations that meet your clients’ needs.

For more than 35 years, we've been committed to helping advisers and their clients succeed for the long term. That’s why we’ve put the full weight of our strengths––data, research, and design––into supporting the future of financial planning across the globe.

Explore our financial planning capabilities

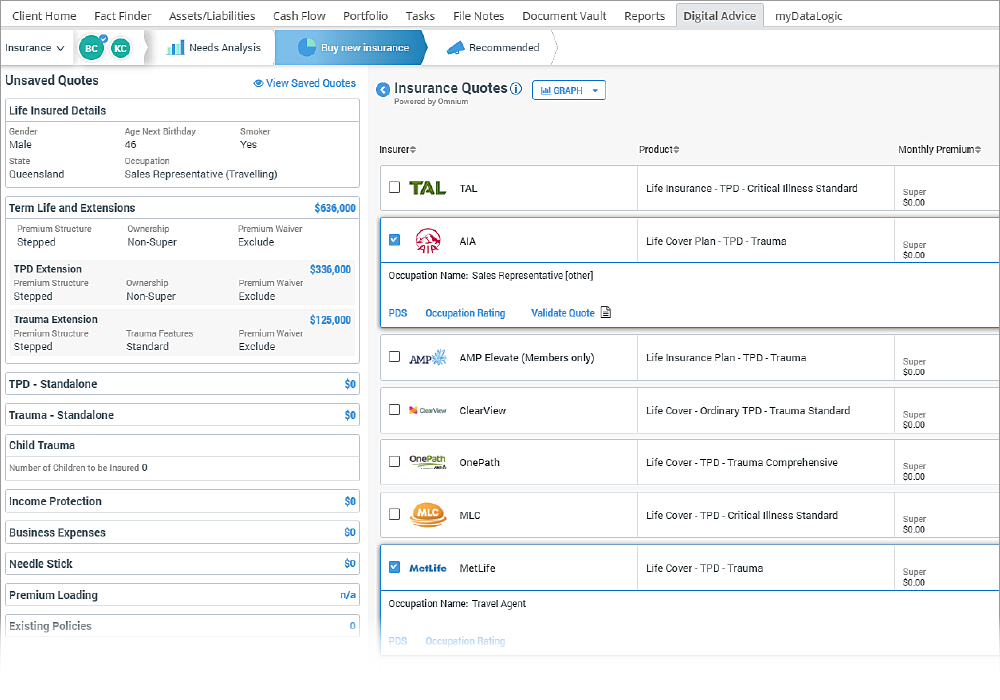

CRM, Financial Planning and Practice Management

AdviserLogic is our easy-to-use financial planning and practice management software. It is designed to support the advice process by driving efficient business management, addressing compliance obligations, and increasing client engagement.

Key adviser activities:

- Easily consolidate client records and file notes for regulatory purposes. Get support meeting fee disclosure requirements with templates for FDS production and opt-in management.

- Use our built-in SoA and RoA templates to reduce customisation costs.

- Personalise templates while remaining consistent with your licensee requirements.

- Reduce double entry of data – capture client data once and utilise it throughout the software.

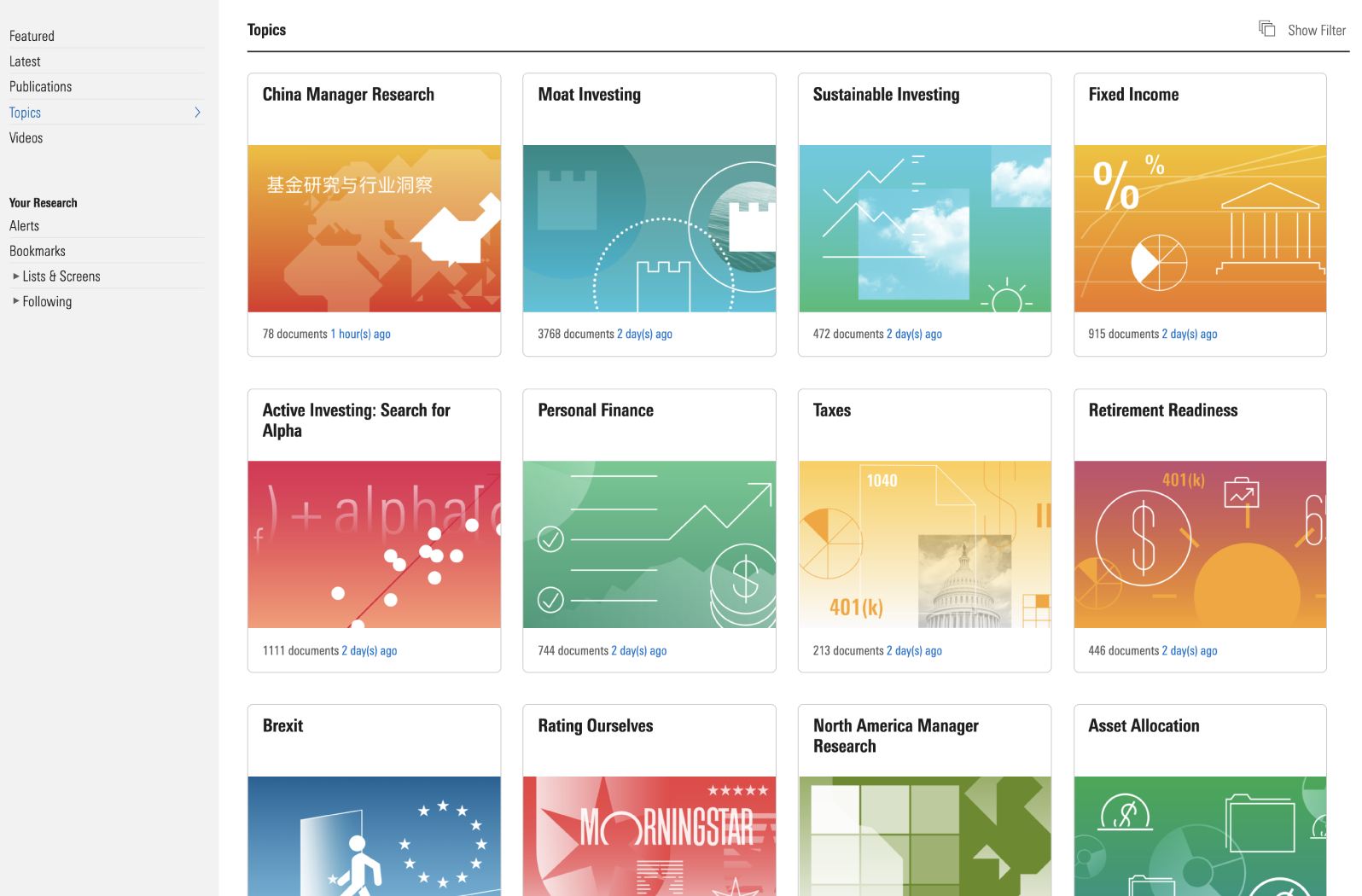

Investment Research, Thought Leadership and Decision Support

Adviser Research Centre is our easy-to-use web-based platform that provides quick access to Morningstar's leading independent research, comprehensive data as well as our user-friendly reporting and analysis tools to help substantiate your advice.

You'll get access to:

- Morningstar’s renowned independent research and ratings on a wide variety of investment vehicles

- Thematic thought leadership and market commentary to keep you and your clients up-to-date

- Client-friendly reports on individual investments and portfolios

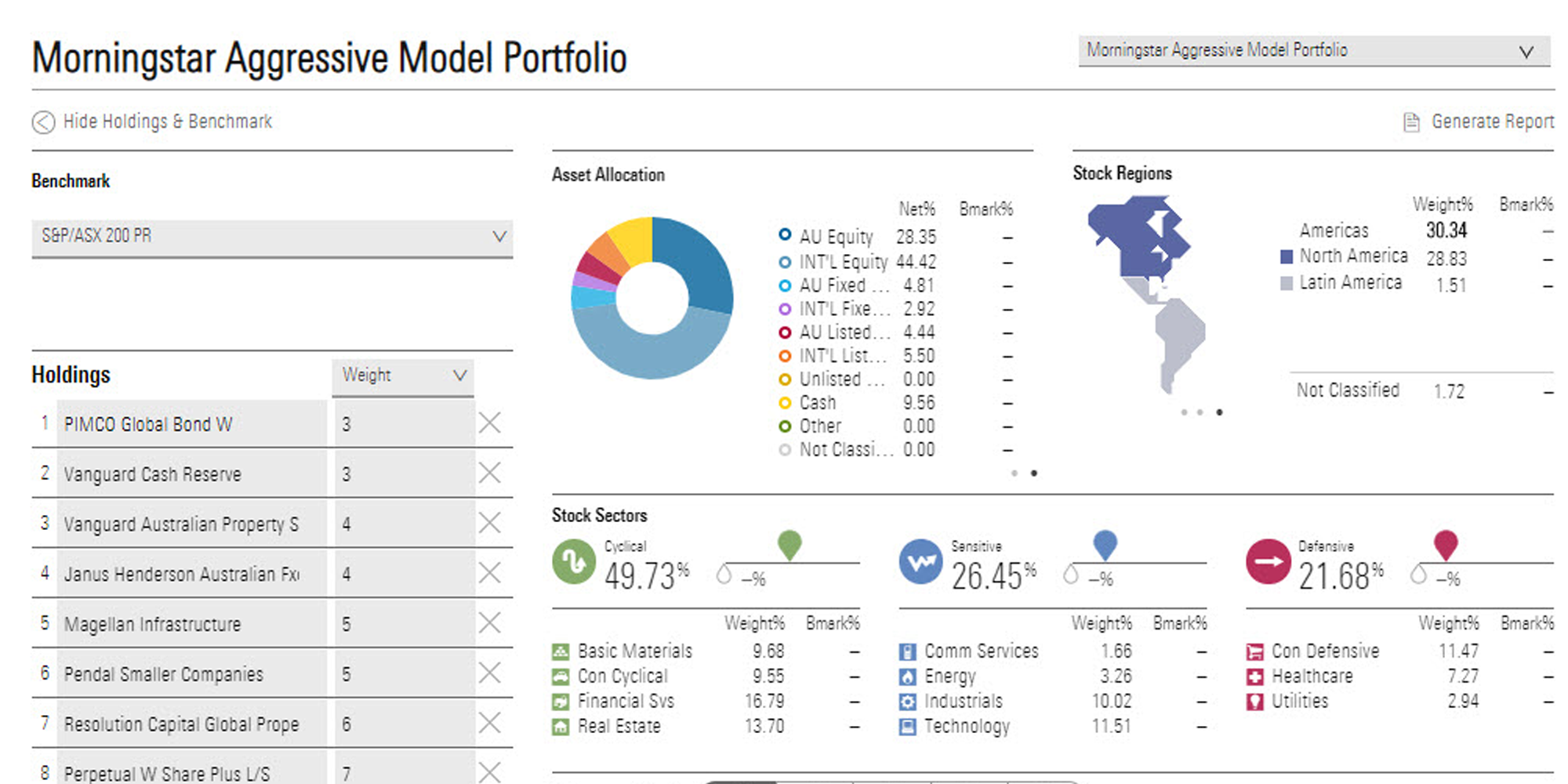

Investment Analysis, Portfolio Construction and Reporting

Morningstar Direct is our sophisticated investment analysis & reporting platform that helps advisers, portfolio managers and head office teams find meaning within data and communicate this information through customised reports and presentations.

Key adviser activities:

- Remove manual data aggregation and have a consolidated source for all required investment data and research

- Automate and document your APL process to create time efficiencies

- Easily create customisable reports for model portfolios and managed accounts

Holistic Risk Profiling

FinaMetrica is the world’s most academically-validated psychometric risk tolerance assessment, to give you confidence in delivering defensible advice to clients while addressing compliance requirements. In just a few minutes, you can understand your client's risk tolerance, so you can give better advice and help them invest more, refer more and stay a client for life. More than 1.5 million FinaMetrica risk tolerance tests have been completed in 35 countries since 1998.

Want to learn more?

Register your details below and our team will be in touch to discuss your needs.

By clicking Submit, you accept Morningstar's Privacy Policy.

© Copyright 2023 Morningstar, Inc. All rights reserved.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts