Optimise Your Value As An Adviser

Advisers today are balancing client relationships, making investments, and monitoring portfolios along with operational and compliance processes. It’s time to evolve your practice, and we can help with Morningstar Direct.

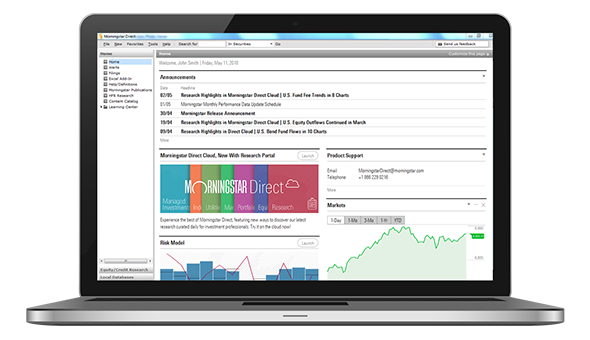

Morningstar Direct is our sophisticated investment analysis & reporting platform that helps advisers, portfolio managers and head office teams find meaning within data and communicate this information through customised reports and presentations.

Morningstar Direct helps automate the manual work involved in managing, monitoring and reporting on APLs, model portfolios and managed accounts.

- Remove manual data aggregation and have a consolidated source for all required investment data and research

- Automate and document your APL process to create time efficiencies

- Easily create customisable reports for model portfolios and managed accounts

Complete the form below to set up your obligation-free demo of Morningstar Direct:

Streamline your daily work

Portfolio Construction

Morningstar Direct provides one, consolidated place for the entering, tracking, and reporting for your model portfolios. Use Morningstar’s unparalleled data as your single source of truth and garner aggregated analytics on your portfolios – and then seamlessly create custom branded reports.

✓ See meaningful analytics on your aggregated portfolios, including over a hundred performance and risk measures

✓ Easily track your portfolios, including any positional changes

✓ Validate changes in the portfolio with the Total Portfolio Attribution Module.

Custom Reporting

Effortlessly create custom branded reports for core uses such as Investment Committee meetings, prospect and client meetings, and managed account fact sheet generation. Have Morningstar Direct run reports automatically on an on-going basis.

✓ Automate your Managed Account/Model Portfolio fact sheet production

✓ Compare multiple investments, including different types of investments, on one report

✓ Build side by side comparisons of portfolios

Increase Efficiency

Access Morningstar’s comprehensive database of quantitative data and qualitative research, and then leverage it to easily conduct customised due diligence to streamline your workflows and minimise compliance risk.

✓ Use the customisable dashboard for on-going monitoring of your APL and for future reference to investment rationales

✓ Access our global stock research, including detailed analytics on the Morningstar fair value estimate

✓ Dig deep into managed funds and see comprehensive holdings and conduct attribution analysis

|

|

|

© Copyright 2025 Morningstar Inc. | Privacy Policy | Legal Notices | Regulatory Disclosures | Global Contacts

Disclaimer: Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice has been prepared without reference to your financial objectives, situation or needs. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar Australasia Pty Limited (MAPL) (ABN 95 090 665 544, AFS Licence 240892) and/or Morningstar Research Ltd, are subsidiaries of Morningstar, Inc., a leading provider of independent investment research in North America, Europe, Australia, and Asia. For more information refer to the MAPL Financial Services Guide (AU). Morningstar Investment Management Australia Limited (MIMAL) (ABN 54 071 808 501, AFS Licence 22896) is the Responsible Entity and issuer of the Morningstar Investment Funds. For more information refer to the MIMAL Financial Services Guide. MAPL and MRL avoid conflicts of interest by not undertaking or publishing qualitative analyst research on MIMAL’s investment products. |